REBATE CATEGORIES

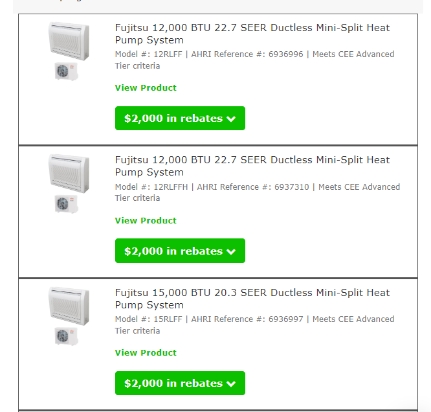

REBATES up to $2,000 *May be combined with other utility Rebates as well!

WHY BUY NOW?Do the math: Buy a new High Efficiency Heat Pump now for $3,000 then cut $2,000 off from your rebate.Your new systems total cost is only $1,000.

OR VISIT OUR REBATE CENTER

REBATES up to $600 *May be combined with other utility Rebates as well!

WHY BUY NOW?Our rebate-qualified AC units starts at $2,400. And when you get your $600 rebates.Your new systems total cost is only $1,800.

OR VISIT OUR REBATE CENTER

REBATES up to $800 *May be combined with other utility Rebates as well!

WHY BUY NOW?Our rebate-qualified furnace units starts at $2,500. And when you get your $800 rebates.Your new systems total cost is only $1,700.

OR VISIT OUR REBATE CENTER

$400 REBATES

- CLAIM WITHIN 30 DAYS OF PURCHASE

- CANNOT BE COMBINED WITH OTHER UTILITY REBATES

- PROOF OF PURCHASE REQUIRED

- CONTACT UTILITY FOR DETAILS AND REGULATIONS

$50 REBATES

- CLAIM WITHIN 90 DAYS OF PURCHASE

- CANNOT BE COMBINED WITH OTHER UTILITY REBATES

- PROOF OF PURCHASE REQUIRED

- MUST BE INSTALLED IN SERVICE TERRITORY

THE INFLATION REDUCTION ACT (IRA)

Provides several incentives for installing or upgrading heating and cooling systems with higher energy efficiency to reduce greenhouse gas emissions.

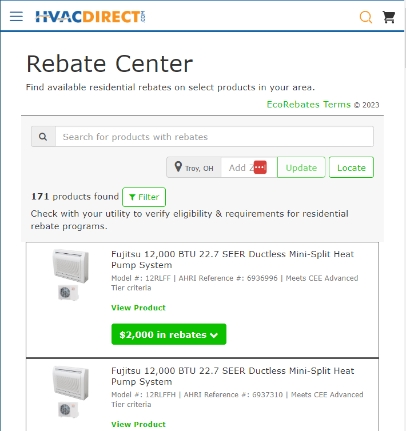

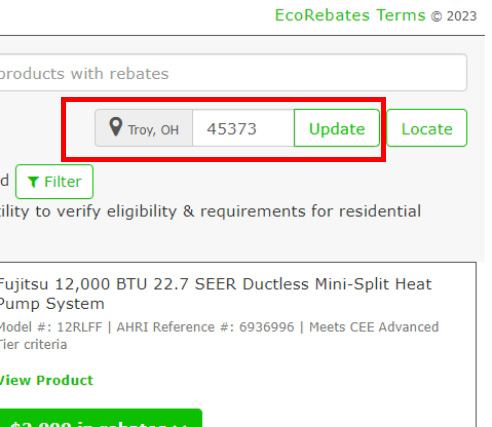

VISIT OUR REBATE CENTER FOR ALL

REBATES IN YOUR AREA

Step 1: Visit hvacdirect.com/rebate-center

Step 2 Enter your Zip Code

Step 3 Start browsing rebates

WHO CAN CLAIM THESE REBATES

HOUSE

BOATHOUSE

MOBILE HOME

COOPERATIVE APARTMENTS

CONDOMINIUM

MANUFACTURED HOME

New Construction & Rentals DO NOT Qualify

FEDERAL TAX CREDIT

Energy-efficient heat pumps give you the biggest rebates, up to $2,000, with other rebates up to $1,200 for the insulation. Other products like energy-efficient air conditioners, furnaces, and water heaters are eligible, but their rebates are only up to $600, $800, and $400 depending on your location.

You can combine a heat pump installation with window/door replacements. In that scenario, the $2,000 credit for the heat pump could be combined with tax credits up to $600 total for the windows/skylights plus $500 for two or more doors.

If you replace your water heater the following year, you would be eligible for another 30% tax credit, up to $2,000 plus up to $600 if you need an electric panel upgrade to accommodate the new water heater.

The overall total limit for an efficiency tax credit in one year is $3,200.

This breaks down to a total limit of $1,200 for any combination of home envelope improvements (windows/doors/skylights, insulation, electrical) plus furnaces, boilers, and central air conditioners.

Any combination of heat pumps, heat pump water heaters and biomass stoves/boilers are subject to an annual total limit of $2,000.